Compound interest

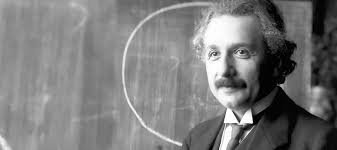

"Compound interest is the most powerful force in the universe" said physicist Albert Einstein at the time. Expressed in practical terms, it is about reinvesting all the profits that are obtained from an investment.

Used to our advantage, it works in a good way, this means that if we reinvest the profits obtained from an investment, this capital will grow exponentially every year. As an example, if you invest $1,000 and have a return of 10% per year, at the end of that year you will have $1,100, but if you return to a return of 10% the following year, at the end of that year 2, you will no longer have $1,200 but $1,210 , at the end of year 5 you will have $1610, and so on, and only starting with a capital of $1000.

Used in reverse it is lethal, the effect is exactly the opposite, it works against us. This happens when, for example, we request a loan from the bank, in this case the bank uses compound interest in its favor, and the amount to be paid grows as the credit extends over time.

In other words, compound interest will work in our favor if we use the correct investment concepts, and now, if we add annual capital contributions to this fantastic formula, the result is already abysmal. The use of capital and the understanding of compound interest over time is key to our financial progress.

We will use a practical example to demonstrate the power of compound interest. Suppose you have a child and at birth you decide to open an investment account in his name with an initial amount of €5,000 as a gift. Over the years you make annual contributions of €1,000 to the account, which is less than €100 per month. This money is managed by a good manager who achieves an average annual return of 13%, and it is not touched until your child reaches 30 years of age. By then, your son will have an interesting figure of €526,895, more than half a million euros, and although by then we will have to adjust this amount for inflation, it will still be a good amount of compound money.

This exemplifies the power of compound interest at its best, demonstrating how a small initial investment, combined with modest annual contributions and a solid interest rate, can generate exponential growth over the long term. The key is to be patient and let compound interest do its work. Also, it's important to note that even if you don't have a generous grandmother, you can still start investing small and grow your money over time.

In this link you can practice different scenarios and variables by changing the boxes main (initial contribution), addition (annual contributions), years to grow (years of investment) and interest rate (the annual rate of return of the money invested).

In short, compound interest can be a powerful tool in the investment world if applied properly. It´s important to understand that the annual rate of return and time are the two key variables to obtain great results in our investments. Little by little we will see examples and the way to achieve that double-digit "annual rate of return (%)", (if possible), and the "time" will only be achieved, if you start today!